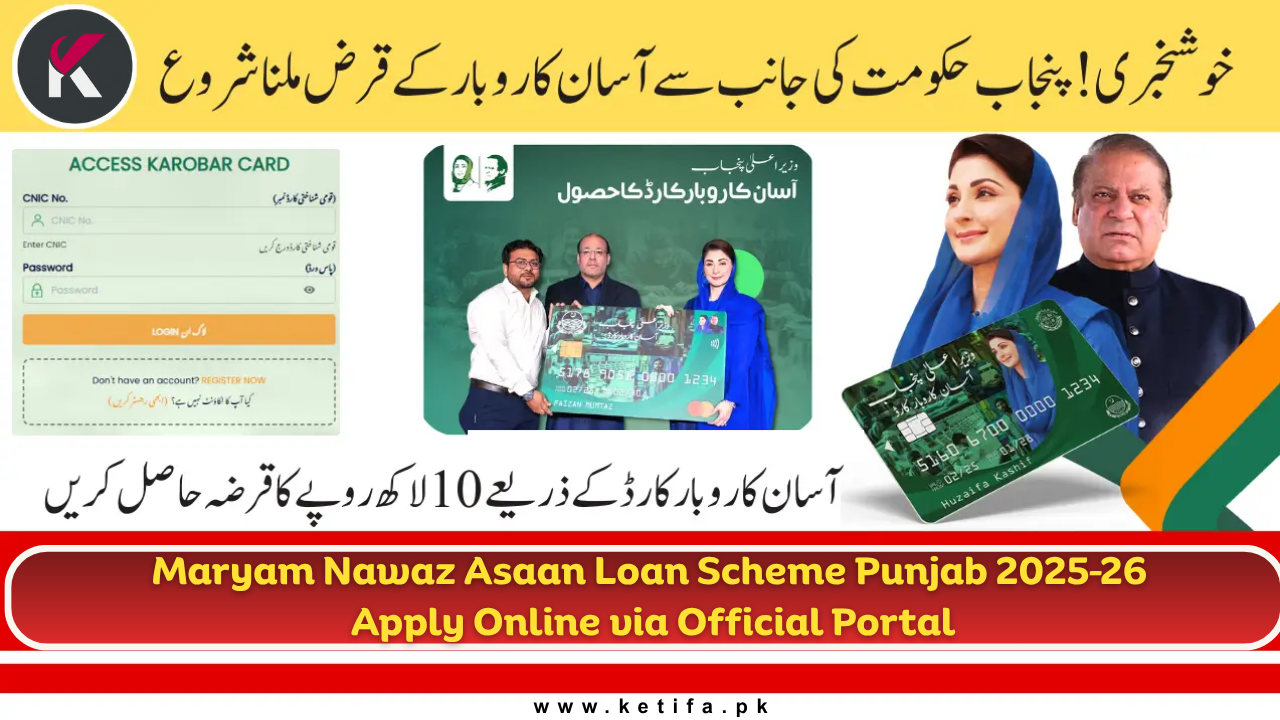

In a major step to empower young entrepreneurs, women, and small business owners, Chief Minister Maryam Nawaz Sharif has launched the Punjab Asaan Loan Scheme 2025–26. This government-backed initiative aims to provide easy, interest-free and low-markup loans to help citizens start or expand their businesses.

With a simple online application process and digital disbursement via the Punjab Asaan Karobar Card, the scheme is designed to boost entrepreneurship, create jobs, and promote financial inclusion across Punjab.

What Is the Maryam Nawaz Asaan Loan Scheme Punjab?

The Maryam Nawaz Asaan Loan Scheme is a flagship economic empowerment program introduced under the Punjab government’s Youth and SME Development Plan.

It provides loans ranging from Rs. 1 lakh to Rs. 3 crore — tailored for individuals, startups, freelancers, and established businesses. The scheme’s goal is to make business financing easier, transparent, and accessible to every eligible citizen without complicated banking procedures.

“This program will help youth, women, and small traders turn their ideas into successful ventures while contributing to Punjab’s economic growth.”

— Maryam Nawaz Sharif, Chief Minister Punjab

Objectives of the Asaan Loan Scheme 2025–26

| Objective | Description |

|---|---|

| Empower Youth & Women | Provide accessible financing to young entrepreneurs and female business owners. |

| Strengthen SMEs | Support small and medium enterprises with sustainable funding. |

| Promote Job Creation | Encourage self-employment and reduce unemployment. |

| Foster Digital Finance | Introduce transparent, cashless transactions via digital banking. |

| Offer Low-Markup Loans | Provide easy financing with minimal or no interest. |

This inclusive approach aims to reduce financial barriers, boost economic self-reliance, and encourage innovation in Punjab’s growing business landscape.

Punjab Asaan Karobar Card – Digital Banking for Entrepreneurs

A unique feature of the scheme is the Punjab Asaan Karobar Card — a smart digital card for managing loans and payments efficiently.

Key Benefits:

-

Direct loan transfer to the card account

-

Repayment through mobile banking or ATMs

-

Acts as verified business identity

-

Access to government incentives and training

-

Secure, paperless transactions and record keeping

This initiative aligns with Digital Punjab 2025, promoting e-governance and financial transparency.

Loan Categories and Limits

The program offers four loan categories to meet the needs of businesses at different stages:

| Category | Loan Amount | Repayment Duration | Target Group |

|---|---|---|---|

| Micro Loan | Rs. 1 Lakh – Rs. 5 Lakh | Interest-free, up to 3 years | Students, freelancers, women |

| Small Loan | Rs. 5 Lakh – Rs. 20 Lakh | Low markup, up to 5 years | Traders, shopkeepers, service providers |

| Medium Loan | Rs. 20 Lakh – Rs. 1 Crore | Low markup, up to 7 years | SMEs, agriculture, tech startups |

| Large Loan | Rs. 1 Crore – Rs. 3 Crore | Flexible, commercial terms | Industries, manufacturers |

Each loan type includes tailored repayment plans and flexible eligibility conditions to ensure maximum accessibility.

Eligibility Criteria – Who Can Apply?

The Punjab Asaan Loan Scheme is open to all eligible residents of Punjab who meet the following requirements:

-

Must hold a valid CNIC and Punjab domicile

-

Age: Between 18 and 55 years

-

Must have a business idea or existing enterprise

-

Women, differently-abled persons, and freelancers are encouraged to apply

-

Must have an active mobile number registered with CNIC

Documents Required for Application

Prepare the following documents before applying (each under 2MB, scanned clearly):

| Document | Purpose |

|---|---|

| CNIC (Front & Back) | Identity verification |

| Domicile Certificate | Proof of Punjab residency |

| Passport-size Photo | Profile identification |

| Proof of Income / Business | For existing enterprises |

| Educational Certificates | For students or startups |

| Basic Business Plan | For loans above Rs. 5 lakh |

Incomplete or unclear documents may delay approval, so applicants should upload high-quality scans.

Step-by-Step: How to Apply Online

Applying for the Maryam Nawaz Asaan Loan Scheme 2025 is 100% online and takes only a few minutes:

-

Visit the official portal: Punjab Asaan Loan Portal (example domain)

-

Click on “Register as New Applicant”

-

Enter CNIC, mobile number, and email

-

Upload required documents

-

Select your loan category

-

Provide business details (type, cost, profit estimate)

-

Review all data carefully and click Submit

-

Save your Tracking ID to check your application status

-

Wait for SMS confirmation and bank verification

💡 Tip: Always double-check your CNIC and mobile number before submitting — mismatched data can cause delays.

Loan Disbursement and Repayment

Once approved, the loan amount is transferred directly to the applicant’s Punjab Asaan Karobar Card.

Repayment Options:

-

Bank apps or online transfer

-

Over-the-counter payments at partner banks

-

Auto-debit setup for regular installments

Borrowers also receive training on financial management and digital payments to ensure responsible repayment.

Business Training & Mentorship Support

The scheme is more than just a loan — it’s a complete entrepreneurial support system. Beneficiaries receive:

-

Business management and marketing training

-

Digital finance workshops for online transactions

-

Mentorship programs by Punjab Small Industries Corporation

These programs ensure that participants not only receive funding but also gain skills to run their ventures successfully.

How the Scheme Empowers Youth & Women

The Asaan Loan Scheme Punjab focuses on inclusive growth by supporting those often excluded from formal financing.

| Group | Benefit |

|---|---|

| Youth | Launch startups, tech ventures, or freelancing projects |

| Women | Start home-based or small retail businesses |

| SMEs | Expand operations and create jobs |

| Farmers | Buy machinery and adopt modern farming methods |

This targeted approach helps build a self-reliant economy powered by local entrepreneurship.

Key Highlights – Punjab Asaan Loan Scheme 2025–26

| Feature | Details |

|---|---|

| Program Launched By | CM Maryam Nawaz Sharif |

| Loan Range | Rs. 1 Lakh – Rs. 3 Crore |

| Eligible Applicants | Punjab Residents (18–55 years) |

| Priority Groups | Youth, Women, Differently-abled |

| Interest Rate | Interest-free to low markup |

| Application Process | 100% Online |

| Repayment Period | Up to 7 Years |

| Disbursement Method | Punjab Asaan Karobar Card |

Common Mistakes to Avoid

- Submitting incomplete or unclear documents

- Using a number not linked to CNIC

- Providing false business details

- Ignoring SMS or email notifications

Following all instructions carefully increases your chances of quick approval.

How to Check Application Status

Tracking your loan status is easy:

-

Visit the official Asaan Loan Portal

-

Click on “Check Application Status”

-

Enter your Tracking ID and CNIC

-

View real-time updates about your application progress

Impact on Punjab’s Economy

The Maryam Nawaz Asaan Loan Scheme is expected to create thousands of jobs, strengthen SMEs, and encourage digital banking adoption across the province.

It will also promote female entrepreneurship, financial inclusion, and sustainable business growth, setting a new standard for economic empowerment in Pakistan.

Final Words

The Maryam Nawaz Asaan Loan Scheme 2025–26 marks a turning point in Punjab’s economic policy — shifting focus from unemployment to entrepreneurship.

With its digital loan process, transparent system, and skill development programs, this initiative provides the tools for individuals to build their future and contribute to Pakistan’s growth story.

If you’re ready to start your journey toward financial independence —

👉 Apply now on the official Punjab Asaan Loan Portal.